The penalty is usually 5% of the amount due for each month or part of a month your return is late. Do not attach the statement to Form 4868/form 7004 You are considered to have reasonable cause for the period covered by this automatic extension if at least 90% of your actual 2014 tax liability is paid before the regular due date of your return through withholding, estimated tax payments, or payments made with Form 4868/form 7004.Ī late filing penalty is usually charged if your return is filed after the due date (including extensions). Attach a statement to your return and explain the reason in completely. The late payment penalty will not be charged if you can show reasonable cause for not paying on time. It is charged for each month or part of a month the tax is unpaid. The late payment penalty is usually ½ of 1% of any tax (other than estimated tax) not paid by April 15th, 2015. Hence, Efile your return or tax extension by the due date and pay as much as you can if you owe IRS any unpaid taxes.

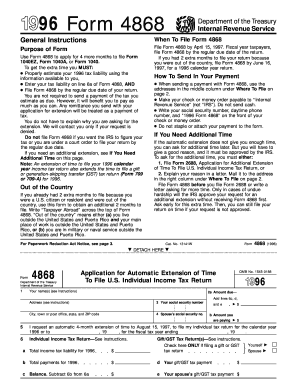

The IRS explains that by doing this you will not have to file a separate extension form. Then indicate that the payment is for an extension using Direct Pay, the Electronic Federal Tax Payment System (EFTPS), or a credit/debit card. In addition, you can also get an extension if you pay all or some of your estimated income tax due. Otherwise, you can fill out the Form 4868, which is the Application for Automatic Extension of Time To File U.S.

#Tax e file extension 2016 irs free#

If you would like to e-file for an extension via Free File Software, there are many options on the official IRS website. When filing for a free tax return extension, you will have six extra months to file your return, with Octoas your new deadline. How You Can Help Ukraine: Verified Charities, GoFundMe & Ways to Support Ukrainians

0 kommentar(er)

0 kommentar(er)